Understanding Pocket Option Leverage: Unleashing Trading Potential

https://pocket-option-kz.ru/kreditnoe-plecho/

In the fast-paced world of online trading, leverage is a crucial concept that can significantly influence your financial outcomes. Pocket Option leverage, in particular, offers traders the ability to amplify their trading capabilities and potentially increase their returns. But what exactly is leverage, and what should you keep in mind when utilizing it on the Pocket Option platform? This article will delve into these questions, providing an insightful guide to get the most out of leverage in trading.

What is Pocket Option Leverage?

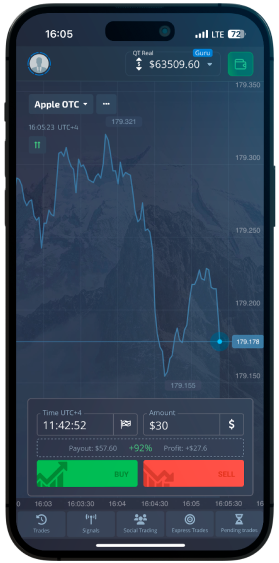

Leverage in the context of trading refers to the use of borrowed capital to increase the amount of trading power a trader holds. Simply put, it allows traders to control a larger position in the market with a smaller amount of actual capital. Pocket Option leverage enables traders to open positions that considerably exceed their actual account balance, providing the potential for higher returns.

The mechanics of leverage are quite straightforward. For instance, if a trader uses a 1:10 leverage ratio, every dollar they invest effectively controls ten dollars in the market. This means that even a small move in the market can result in substantial profits or, conversely, significant losses, which means leverage must be used wisely.

The Benefits of Leverage

The primary advantage of Pocket Option leverage is the ability to maximize your trading potential. By using leverage, traders can engage in positions much larger than they could with only their actual capital investment. This can lead to greater profits on successful trades compared to what would be possible without leverage.

Additionally, leverage provides traders with increased flexibility and the opportunity to diversify their trading portfolios. With leverage, traders can hold positions in multiple assets simultaneously without needing the full capital normally required to do so. This diversification can help mitigate risk, as it minimizes the impact of any single trade on the overall portfolio.

The Risks of Trading with Leverage

Despite its benefits, trading with leverage also comes with significant risks. It’s crucial to understand that while leverage can amplify profits, it can also magnify losses. This means that traders can lose capital much faster compared to trading without leverage, potentially resulting in substantial financial losses.

Moreover, market volatility can significantly impact leveraged positions. Rapid price changes can lead to margin calls, requiring traders to either increase their margin or close positions prematurely. As such, managing leverage requires discipline, effective risk management strategies, and continuous monitoring of market conditions.

How to Use Pocket Option Leverage Effectively

For those eager to leverage Pocket Option leverage effectively, it’s vital to maintain a strategic approach. Firstly, using leverage should be based on thorough research and understanding of the market dynamics. Traders should consider the volatility and historical behavior of the assets they’re trading, ensuring they’re comfortable with the associated risks.

Implementing sound risk management practices is paramount. This includes setting stop-loss orders to limit potential losses and defining clear profit targets to safeguard gains. Many experienced traders recommend using only a portion of their account balance for leveraged trades, as this can help mitigate the risk of significant capital losses.

Additionally, keeping abreast of market news and economic indicators can provide invaluable insights, allowing traders to anticipate potential market movements and adjust their leveraged positions accordingly. Continuous education and staying informed are key elements for successful trading with leverage.

Conclusion

Pocket Option leverage is a powerful tool that, when used wisely, can offer exciting opportunities for traders aiming to maximize their trading potential. However, understanding the balance between potential rewards and inherent risks is vital to success. By implementing disciplined risk management strategies, conducting thorough research, and maintaining awareness of market conditions, traders can navigate the complexities of leverage and enhance their trading experience on the Pocket Option platform.

For more detailed resources and to enhance your understanding of leverage, you can explore Pocket Option leverage.

Write a comment: